Excellent Post.

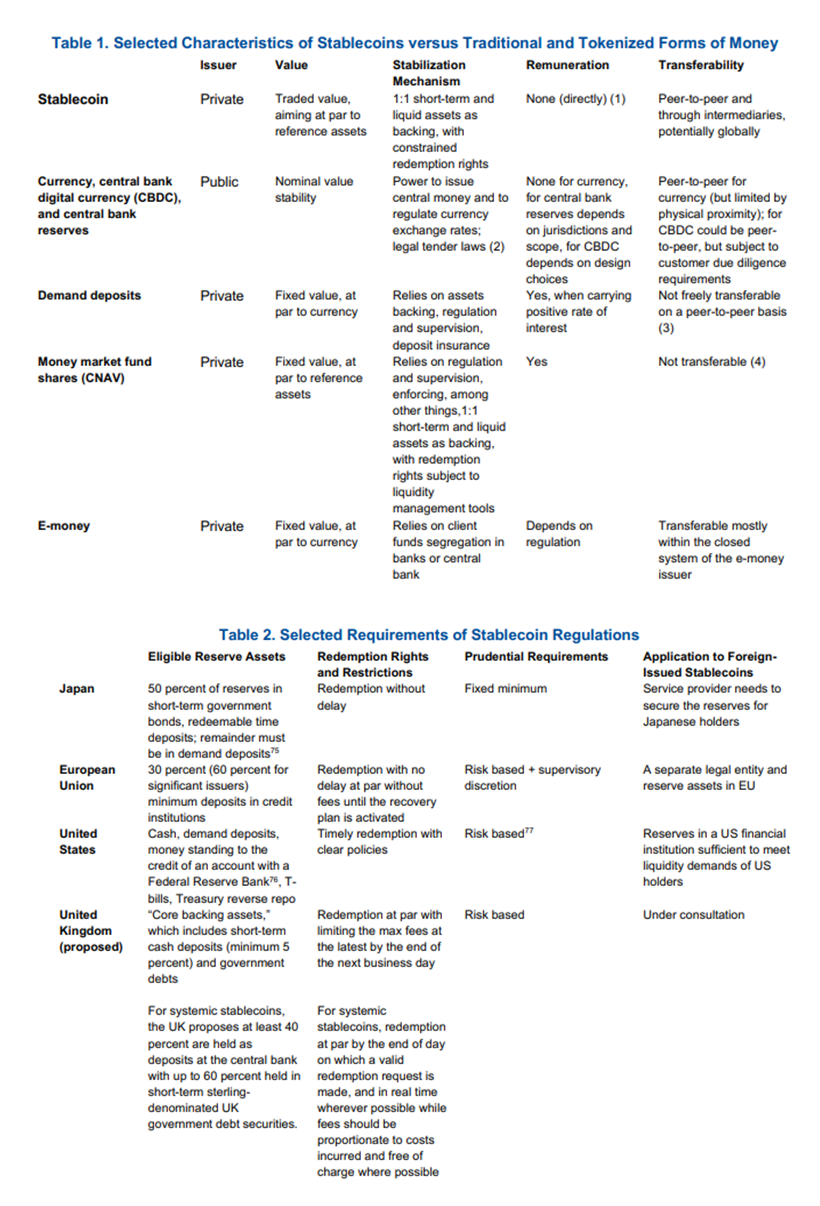

A couple of tables within the document that complement the summary:

------------------------------

Carlos Salas

Portfolio Manager & Freelance Investment Research Consultant

------------------------------

Original Message:

Sent: 07-12-2025 15:50

From: Todor Kostov

Subject: Understanding Stablecoins (IMF report)

IMF published a report on stablecoins this week:

"Understanding Stablecoins"

PDF

Brief summary:

- Stablecoins, unlike other crypto assets, aim to maintain a fixed parity relative to a specific currency. Stablecoins have commonality and differences with other crypto assets ("unbacked crypto assets"). Like unbacked crypto assets, they are issued on distributed ledgers, typically blockchains. Unlike unbacked crypto assets, they are generally issued and operated in a centralized manner by entities such as crypto firms or financial institutions, which aim to maintain a fixed parity relative to a specific currency, and have backing assets. Indeed, stablecoin issuers usually back the stablecoins in circulation 1:1 with short-term, liquid financial assets. The large majority of currently existing stablecoins is denominated in United States dollars.

- Stablecoins are currently mostly used for crypto trades, although they have the potential to be used in other payment transactions. Stablecoin issuance has doubled over the past two years, driven by their use in crypto trades-acting as a bridge between volatile unbacked crypto assets and fiat currencies-albeit with an expansion in use cases to include cross-border payments. The future demand for stablecoins could arise from other use cases-like use in domestic payments-building on greater incentives and confidence provided by enabling legal and regulatory frameworks. Estimates on stablecoins' future growth vary widely.

- Stablecoins differ from existing forms of traditional and tokenized assets in several dimensions. Stablecoins are part of the broader trend of asset tokenization-the representation of assets on distributed ledgers, providing a new infrastructure and process through which assets are recorded, issued, and transferred-although stablecoins differ from traditional and tokenized assets in several key ways. Unlike central bank money and deposits (and their potential tokenized form), stablecoins could offer less stability if regulatory frameworks do not address the potential market and liquidity risk of their backing assets and generally provide-at the current juncture-more limited redemption rights. Unlike money market funds (and their tokenized version), stablecoins do not pay returns, at least not directly. Unlike some other tokenized assets, but similarly to unbacked crypto assets, stablecoins generally offer peer-to-peer transferability on public blockchains.

- Stablecoins offer several potential benefits. Through tokenization, stablecoins could increase efficiency in payments- particularly cross-border transactions, including by reducing the costs and enhancing the speed of remittances-and widen access to digital finance through increased competition. For some users, they could also offer a more comprehensive user experience by integrating with the crypto world while still being used in other transactions.

- Stablecoins could also carry significant risks-in the absence of adequate regulations and backstops-that would be more pronounced in countries with weaker macroeconomic fundamentals and institutions. These risks are related to macrofinancial stability, operational efficiency, financial integrity, and legal certainty. The risks would mostly arise in the absence of adequate laws, regulations, supervision, and backstops, and if adoption of stablecoins increases. Stablecoins value can fluctuate due to the market and liquidity risks of their reserve assets. If users lose confidence in stablecoins-especially if redemption rights are limited-this could potentially trigger sharp drops in value. If stablecoins are widely adopted, runs on stablecoins could trigger fire sales of the underlying reserve assets, potentially impairing market functioning. Stablecoins may contribute to currency substitution, increase capital flow volatility by circumventing capital controls, and fragment payment systems unless interoperability is ensured. These risks could be more pronounced in countries experiencing high inflation, in countries with weaker institutions, or in countries with diminished confidence in the domestic monetary framework.

- The regulatory landscape for stablecoins is evolving. The IMF, the Financial Stability Board (FSB), and international standard-setting bodies (SSBs) have issued comprehensive policy recommendations to address risks from crypto assets, including stablecoins. These include (1) safeguard monetary sovereignty and stability by strengthening monetary policy frameworks; (2) maintain the effectiveness of capital flow management measures; (3) address fiscal risks; (4) adopt FSB's high-level recommendations with target measures if appropriate; (5) confirm legal treatment and provide clear guidance; (6) implement and enforce Financial Action Task Force (FATF) standards and address market integrity issues; (7) establish international collaborative arrangements; (8) monitor the impact of crypto assets on the stability of the international monetary system; and (9) strengthen global cooperation.

- Many authorities have started implementing international standards for stablecoins, but the landscape remains fragmented. Emerging regulations and robust implementation would mitigate operational, financial integrity, legal, and macrofinancial risks. However, a comparative analysis of legal and regulatory frameworks in Japan, the European Union, the United States (yet to be fully implemented), and the United Kingdom (still in the proposal stage) highlights different approaches in several important areas, including the type of entities allowed to issue stablecoins, approaches toward foreign stablecoin issuers, segregation and custody requirements, and proportionality toward systemically important issuers. This may create regulatory arbitrage opportunities that could affect the overall effectiveness of the regulations. Moreover, the possibility for some stablecoins to be held through unregulated entities, including unhosted wallets, could limit the effectiveness of regulations.

- The cross-border nature of stablecoins adds complexity for regulators and data compilers, highlighting the need for stronger collaboration, both nationally and internationally. Effectively managing macrofinancial risks-such as currency substitution, volatile capital flows, and payments fragmentation-requires additional measures and enhanced cooperation. As stablecoins operate globally, this also increases the potential for conflicts between domestic policies, making international cooperation even more essential. Moreover, unlike existing financial instruments, stablecoin issuers generally do not have visibility into the residence or nationality of their token holders, which creates significant challenges for data-driven decision making.

- The IMF continues to closely monitor developments and the evolving impact of stablecoins on the international monetary system, offering analysis, guidance, technical assistance, and policy advice to member countries on crypto assets, including stablecoins. As stablecoins continue to develop and integrate into the global financial system, policymakers, regulators, and industry stakeholders need to collaborate and ensure that the potential benefits of stablecoins materialize while addressing increasing risks. This collaborative approach will help create a more resilient and inclusive financial ecosystem, paving the way for innovative financial solutions that can support economic growth.

- Todor

------------------------------

Todor Kostov

Director

------------------------------