Thanks James for bringing GC23/3 to everyone's attention.

I am considering whether we should respond back to the FCA (by 26th January) on the Guidance provided in Annexe I. I am wondering whether our members, particularly those in this Sustainability Community have some interesting comments to make on it. If you are reading this and do have an observation about a gap, something your disagree with or a suggestion to improve the presentation in the guidance, can you let me know?

I also note there's a very good short piece on-line form A&O on this. The following section in particular I thought worth bringing to everyone's attention:

What should I do?

The guidance is not long, comprising just six and a half pages, and is set out in Annex I of the consultation.

Our recommendations:

- Read and consider the draft guidance.

- Consider which internal teams, divisions etc make ESG-related claims.

- Sense check the draft guidance against existing policies and procedures to consider if they would survive a challenge.

- Collect a sample of historically made claims, statements etc and sense check them against the FCA draft guidance.

In our view, this is a prudent approach, bearing in mind that the FCA's statements in the consultation and policy statement suggest it believes that industry standards are not where they should be in all respects.

It would be great to hear from any of who do the above as recommended by A&O and as a result find the Guidance either too loose or too strict or in need of adjustment in any way.

Best,

Andy

------------------------------

Andrew Burton, CFA

Professionalism Adviser

CFA UK

07415 952432

------------------------------

Original Message:

Sent: 13-12-2023 10:17

From: James Doyle

Subject: Greenwashing

Thanks Aya,

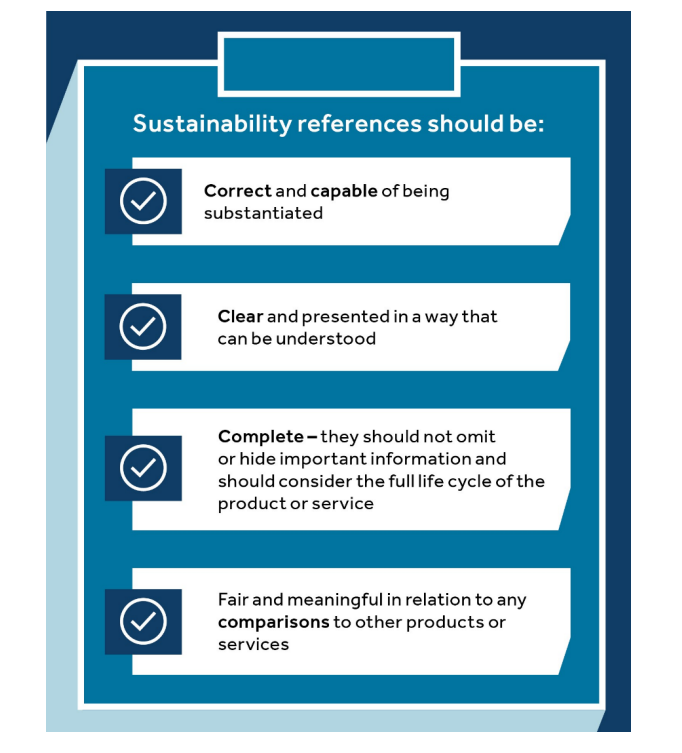

the FCA's recent SDR consultation for draft guidance on anti-greenwashing is helpful and pretty common sense when discuss sustainability claims in relation to investment products and services - it has a fairly broad application as noted below underpinned by following principles - see FCA website for further info: GC23/3: Guidance on the anti-greenwashing rule | FCA

Summary of changes:

Summary of changes:

2.2 The anti-greenwashing rule requires FCA-authorised firms to ensure that any

reference they make to the sustainability characteristics of their financial products

and services are consistent with the sustainability characteristics of the product or

service and are fair, clear and not misleading.

2.3 The rule applies to all communications about financial products or services which

refer to the environmental and/or social (ie, 'sustainability') characteristics of those

products or services. Sustainability-related references can be present in, but are not

limited to, statements, assertions, strategies, targets, policies, information, and

images.

2.4 A sustainability-related claim may be any claim which includes references relating to

the sustainability characteristics of a product or service. So, it could be a claim that a

mortgage or savings account is 'green' or that an investment or pension fund is

'sustainable' and aims to deliver positive outcomes for people or the planet. It could

also include, but is not limited to, claims relating to the environment, climate or

climate change, biodiversity and nature, social issues, or corporate social

responsibility.

------------------------------

James Doyle

Director, Green Finance, Investment Management

Original Message:

Sent: 13-12-2023 10:00

From: Aya Pariy

Subject: Greenwashing

Good morning community!

We had a great online meetup yesterday, thank you to all who joined and to our speaker guests @Stephen Beer and @Lucas Howarth and also moderators @David Manuel @Denise Gomes de Santana and our host @Beatrice Methe. I will share notes on what was discussed on this platform soon.

Yesterday there was a conversation around greenwashing as well. So i thought I'd share this great analysis of greenwashing by RepRisk. Growing number of both public and private companies have been linked to misleading communication around environmental issues. Greenwashing risk has accelerated in Europe and the Americas, with the Banking and Financial Services sectors particularly exposed.

- In the past year (September 2022 – September 2023), one in every four climate-related ESG risk incidents was tied to greenwashing, an increase from one in five in our last report.

- The Banks and Financial Services sectors saw a 70% increase in the number of climate-related greenwashing incidents in the past year, compared to the year prior.

- For many, the practices go hand-in-hand, with nearly one in three public companies linked to greenwashing also associated with social washing.

Read more here

What do you notice with regards to greenwashing?

------------------------------

Aya Pariy

------------------------------